It has certainly been a rough week for bulls in the S&P 500 (SPY). Over the past 10 days, we’ve now had three big reports all showing hotter-than-expected inflation. And while it looked like the bulls were going to be able to shake off the first two, the evidence is stacking up in favor of additional rate hikes, which might make a bull victory much more difficult now. Here’s what I mean.

(Please enjoy this updated version of my weekly commentary originally published February 24th, 2023 in the POWR Stocks Under $10 newsletter).

Market Commentary

At the end of last week, both CPI and PPI both reported rising month-over-month prices, as well as annual price increases that were larger than economists had expected.

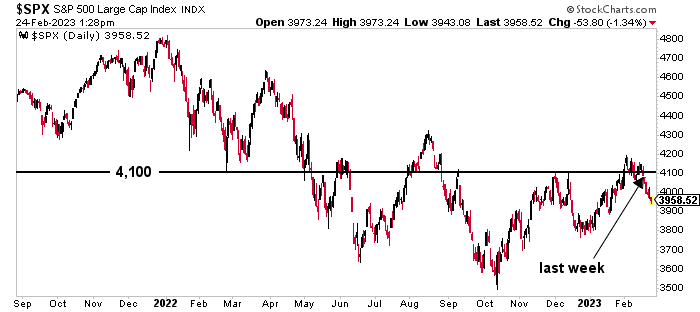

Even so, bulls kept it fairly together, and the S&P 500 (SPY) ended the week just a few points below the important 4,100 line.

Despite the bears racking up some big wins last week, it still looked like this latest round of “tug-o-war” was anyone’s game…

And then the Fed minutes were released. And a third inflation indicator (and the Fed’s favorite) – the personal consumption expenditures (PCE) index – also came in hotter than anyone was expecting. And more Fed officials publicly voiced their concerns that inflation remains too high.

Look, I’ll be the first to say the bulls have put on a surprisingly strong show the first weeks of the year. But this is is going to be a big hurdle to clear for the rally to continue.

But I’m also not going to say it can’t be done. These bulls have always seemed a little bit delusional. There’s not a ton of “bullish” events that have happened… people were just ready to move into a more “risk on” environment.

We’ve also now seen bearish readings from all three signs I recently spotlighted — the 4,100 level (broken below), the January CPI report (hot), and the CME FedWatch Tool (number of people expecting a 50-bps hike in March has nearly tripled from 9.2% to 27%).

They say the market “climbs a wall of worry.” But how high is too high?

I’m not 100% certain. Honestly, anyone who tells you they are is selling you a load of, well, something.

Regardless, the bulls are going to have to put on quite a show with so much evidence pointing toward additional rate hikes and a higher terminal rate.

As such, I want us to take a little time to prepare our portfolio for the next leg lower. I’m not ready to sell anything today, but I spent some time this morning creating trade triggers for most of our holdings.

These will help us keep losses under control and protect the gains we worked hard for over the past months.

Conclusion

The best thing we can do for right now is be prepared. Stocks under $10 are such a strong group because they give us an important edge over major stocks that are priced down to the penny.

But they’re also susceptible to bigger price swings during selloffs. That’s why we’re keeping things locked down tight as we navigate what happens next.

What To Do Next?

If you’d like to see more top stocks under $10, then you should check out our free special report:

What gives these stocks the right stuff to become big winners, even in this brutal stock market?

First, because they are all low priced companies with the most upside potential in today’s volatile markets.

But even more important, is that they are all top Buy rated stocks according to our coveted POWR Ratings system and they excel in key areas of growth, sentiment and momentum.

Click below now to see these 3 exciting stocks which could double or more in the year ahead.

All the Best!

Meredith Margrave

Chief Growth Strategist, StockNews

Editor, POWR Stocks Under $10 Newsletter

SPY shares closed at $396.38 on Friday, down $-4.28 (-1.07%). Year-to-date, SPY has gained 3.65%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Meredith Margrave

Meredith Margrave has been a noted financial expert and market commentator for the past two decades. She is currently the Editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Meredith’s background, along with links to her most recent articles.

The post Hot Inflation Means a Rough Ride for Bulls Ahead… appeared first on StockNews.com