For most prospective small business owners, many of the costs of running a business are clear from the beginning of the process. Expenses like leasing commercial office or retail space, equipment, product inventory, and payroll, for example, usually don’t come as a shock to entrepreneurs who are planning their business startup costs.

So, why do so many of them end up running into issues with the bottom line?

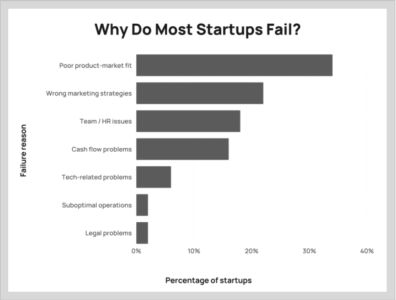

According to the latest data from the US Bureau of Labor Statistics, a staggering 90% of startup businesses ultimately fail in the long run. Among these, 16% fail due to cash flow problems or other financial issues—and that figure doesn’t even count startups that fail due to poor marketing strategies or a bad product-market fit.

In many cases, it’s not that these businesses fail to account for these predictable one-time expenses or their fixed costs—despite the fact that they’re typically on a tight budget. Rather, it’s a lack of preparation for the unforeseen problems that arise when running a business, and the unexpected costs that come as a result.

With a virtually infinite number of types of startup business, a wide variety of possible unexpected expenses exist. With that said, some of the hidden costs of starting a business seem to come up frequently despite the industry—let’s examine some below.

Shrinkage

Shrinkage, or inventory shrinkage, is an accounting term that describes when a business has less items in its actual inventory than has been recorded in the balance sheet. In other words, if physical inventory is less than recorded inventory, shrinkage has occurred. The calculation for inventory shrinkage is simple:

Shrinkage = Recorded Inventory – Actual Inventory

What Causes Shrinkage?

Common factors that contribute to inventory shrinkage include the following:

- Shoplifting

- Employee theft

- Vendor fraud

- Administrative errors

- Damaged product

Put simply, inventory shrinkage refers to preventable losses that are either deliberate or arise from human error. Shrinkage is a big issue for any business—big or small—that sells physical goods. Typically, a small amount of shrinkage is unavoidable. If it gets out of hand, however, the bottom line can be negatively affected—especially in businesses with thin profit margins.

Retailers, for example, are hit the hardest by inventory shrinkage as their business models often rely on moving products in large volume with a small profit margin. In fact, according to the National Retail Security Survey released by the National Retail Foundation, inventory shrinkage accounted for a peak $61.7 billion loss for US retailers in 2019.

Shrinkage isn’t just limited to retail businesses though. Things like vendor fraud, employee theft, and clerical errors can affect businesses of just about any kind. For example, food service businesses can experience shrinkage if food items arrive expired, if less items actually arrived than are recorded, and even from things like employees taking food.

Preventing Shrinkage

In many cases, implementing a few new processes can help to reduce an organization’s shrinkage. Focus on better communication, clarity around organizational policies, and proper training of employees to create a culture of accountability and efficiency in the workplace.

Additionally, better technology for inventory accounting, employee management, and security are all powerful tools for combating shrinkage in any industry.

Another simple, but very effective measure to take is making a habit of double and triple checking vendors’ deliveries. In many cases, checking every single one for errors like missing or damaged products is enough to stop some major issues in their tracks.

Merchant Fees

Merchant fees, or credit card processing fees, are a percentage of each transaction charged by a merchant service (such as VISA, MasterCard, or American Express) to a vendor for processing credit card transactions.

In a world where eCommerce is becoming more and more commonplace, especially for small businesses, this becomes even more relevant because transaction fees are typically higher for online purchases—creeping as high as 2-3% per transaction. This can have a big effect on an online retailer’s bottom line!

How to Save Money on Merchant Fees

There are several ways a business can try to bring down these transaction fees, including the following:

Negotiating Lower Transaction Fees

Credit card processors are motivated to work with organizations that deal in high volume, as they get more fees. As a business grows and shows steady increases in its revenue and transactions, business owners should continually check if they’re getting the best deal possible.

Take Steps to Minimize the Risk of Fraud

The risk of fraudulent transactions is factored into processing fees, so boosting the security of each transaction helps to reduce this risk, and thus, the fees.

This can be as simple as ensuring cards are swiped/have their chip read as often as possible in physical locations, or requiring certain security information (such as a billing address) in online transactions.

Properly Set Up POS Terminal

Simply having their payment terminal and account set up the right way from the beginning will help most businesses to lower processing fees to merchants. Factors like business type, transaction types, and frequency of transactions all play into the final processing fee for each transaction.

Additionally, when the transactions are processed can affect the fee. It’s recommended that businesses process their transactions every 24 hours. The more transactions there are to process, the higher the fee is—so processing them every day reduces the total number of transactions and fees for that period.

Equipment Upgrades, Repairs, and Maintenance

When planning the start of their business, entrepreneurs typically have an idea of what kinds of costs they’ll incur to get the equipment they need. What’s not always considered, though, is that things like IT equipment, company vehicles, tools, and specialty equipment have costs that go far beyond the initial price tag over time.

Take, for example, a small coffee shop. A considerable investment in equipment is required to get a cafe up and running—from coffee machines and industrial-grade blenders to refrigeration, ice machines, an oven, and a dishwasher. And that’s just naming a few!

The cost of all these items can be calculated and accounted for with relative ease before going into business. The tricky part is that it’s almost impossible to be sure of when (not if) the commercial-grade equipment in a business like a cafe will start having issues and need pricey specialized repairs or even replacement.

Big ticket items like dishwashers, walk-in freezers, or commercial ice machines are known for being expensive purchases, but what often catches new business owners off guard is how often equipment like this runs into issues—and that gets pricey.

Combating Surprise Equipment Costs

To counter costs from equipment repairs and upgrades, many businesses have moved to leasing or renting certain heavy equipment items—particularly ones like the small cafe in our example.

Instead of paying thousands up-front and hundreds every time there are equipment issues, renting or leasing things like dishwashers, ice machines, and refrigeration units helps keep costs low, and perhaps even more importantly, predictable.

Even if the equipment is owned, simply planning around these inevitable issues and subsequent costs puts small business owners in a much better position when it comes to unexpected equipment costs. Make cleaning, upkeep, and regular maintenance a priority in daily operations, and budget for repairs ahead of time—not just the cost of equipment.

Expensive Loans

It’s very common for an up and coming business to apply for a small business loan—most entrepreneurs simply don’t have the capital needed to get things up and running without taking out loans of any kind.

For this reason, loans themselves aren’t exactly a “hidden cost,” but not all loans are created equal—some have much more favorable terms for a business that’s trying to make their ends meet.

For instance, small business loans offered by the Small Business Administration are very popular with entrepreneurs because they require lower interest payments, various types of loans available, and offer predictable monthly payments.

And of course, like a personal loan, a good credit score helps to earn more favorable, inexpensive terms when it comes to a business loan.

Be aware, however, that defaulting on an SBA loan can be very costly for a business.

Legal Costs

The extent of legal costs involved with starting a business vary, but are usually involved in some capacity. For example, a prospective entrepreneur might need to meet with a lawyer to discuss which business entity type makes the most sense for their organization.

If the business is going to be incorporated or registered as a limited liability company, articles of incorporation must be filed with that state, which is an additional expense.

Other examples of legal business startup costs include:

Like many of these costs, the extent and amount of legal fees an organization encounters will depend on the type of business in question, and the above instances are just some examples of many possible situations that justify hiring a business lawyer.

Insurance

Going beyond the costs typically associated with employee benefits like medical or life insurance, the business itself also requires several types of insurance. The types of insurance needed largely depend on what type of industry a small business owner operates in and the state the business is located in, but some types are almost always a good idea—like general liability insurance, professional liability insurance, and workers’ compensation insurance if the business has multiple employees.

There’s sometimes overlap in the types of claims that these insurance policies cover, so some providers work with small businesses to create a general small business insurance plan that includes all of the features that specific business needs. As a small business and its revenue grows, naturally, insurance premiums rise.

General Liability Insurance

These insurance policies help protect businesses from claims like bodily injury, property damage, or personal injury like slander or libel. Costs that a policy like this helps cover include:

- Medical expenses if someone is injured at a business

- Judgments, settlements, and other court costs of covered claims against a business

- Costs of property damage claims against a business

- Costs of damage to landlord’s property

- Any administrative costs involved with a business’s covered claims

Professional Liability Insurance

Also referred to as “errors and omissions insurance,” this type of insurance protects businesses from mistakes employees make when providing services or products that result in a financial loss for the customer. This includes claims of:

- Misrepresentation

- Inaccurate advice

- Negligence

- Copyright infringement

Workers’ Compensation Insurance

Often simply referred to as “workers’ comp,” these insurance policies provide medical, wage, and other financial benefits to employees who get injured or become sick at work. Most states do require that most businesses carry some form of workers’ comp—in some cases, even if there’s only one employee or the company is run by a self-employed business owner.

Other Common Types of Small Business Insurance

The types of insurance mentioned above are usually the most common types for small businesses, but let’s examine some other types that are frequently utilized by small businesses below.

Commercial Property insurance

- If a business operates on a physical commercial property like a retail or office space, these policies cover claims of damage . Claims that are covered include property damage from events like floods, fire, or even theft.

Business Income Coverage

- Business income insurance, also commonly referred to as “business interruption insurance,” helps cover any loss in income due to a covered event that leaves a business unable to operate. For example, if a business encounters flood damage, business income insurance will cover the loss of income while repairs are made, while commercial property insurance would cover the costs of the damage itself.

Commercial Auto Insurance

- For companies that have deliveries, service calls, or any other job functions that require a vehicle, commercial auto insurance is usually a good idea. Like personal auto insurance, these policies protect a business in the event of an accident or other road incident involving a company vehicle that results in injury or property damage.

Commercial Umbrella Insurance

- Commercial umbrella insurance essentially extends the coverage of other liability policies a business has. For example, let’s say an employee is driving a company vehicle and gets into an accident that results in property damage and bodily injury to the other party. This company’s commercial auto insurance covers claims up to $1 million, but the injured party seeks damages of $1.3 million. If the company is found liable for the accident and must pay, the commercial umbrella policy would cover the remaining $300,000.

Saving Money on Insurance

One of the first things to keep in mind is that the terms of business insurance, including the costs, can often be negotiated. In fact, there are entire organizations devoted to helping businesses find insurance that works for them and negotiate more favorable terms on the policy.

As previously mentioned, there’s often overlap among different types of insurance—so combining the types of coverage needed into one plan is usually helpful when it comes to that monthly or yearly bill, and most businesses do this in one way or another.

If minimizing monthly costs is a priority (as it often is for small businesses), an organization can raise their deductible in order to lower their premium. If taking this course of action, it’s important to ensure there’s enough money available to pay the deductible if the business must file a claim.

Of course, the best way to save on insurance is to minimize risk. This applies not only to safe practices in daily operations, but the type of business in question as well. Minimizing risks looks different for different types of businesses, but one common denominator is ensuring that safety policies are abundantly clear and rigorously followed by employees.

Digital Services

As time goes on, a digital presence is becoming more and more important for just about every type of business—small or large. And that doesn’t just mean a website anymore, but can also include things like social media and content creation.

To build out a website and buy hosting for it is a big project—and one that is often overpaid for. When it comes to the world of the internet, business owners often feel overwhelmed by the “tech” side of things, allowing vendors to overcharge them for things like building a website, maintaining a social media presence, creating content to attract business, and handling other forms of digital marketing.

Getting the Best Value from Digital Services

Patience and a willingness to learn about what these services actually entail is the first step to being able to effectively shop around for different providers of these digital services—but at the end of the day, adequately shopping around to begin with is a huge step for getting the best value when it comes to an organization’s digital presence.

Rather than being more of an afterthought (as is often the case), these types of vendors should be vetted and treated with the same attention to detail as any other vendor that’s crucial to a business’s operations.

The post 7 Hidden Costs of Running a Small Business appeared first on Due.