An example of grabbing gains from comparative performance with a lower risk China pairs trade on BIDU/PDD.

One of the main strategies we emply at POWR Options is called a pairs trade. We look to identify situations whee the much higher rated stock in the POWR Ratings has dramatically underperformed the much lower rated stock. Buy bullish calls on the higher rated name and bearish puts on the lower rated company.

The expecation is that the relative divergence between the two stocks will be begin to converge. This means we expect the better stock to start outperforming the worse stock with the bullish calls performing better than the bearish puts.

A recent example of a pairs trade done in the POWR Options portfolio may help highlight the strategy.

On October 23, POWR Options saw that C-rated Pinduoduo stock (PDD) had once again begun to outperform the higher B-rated Baidu (BIDU). Both stocks were in the same industry-Chinese Internet. PDD was ranked at 26 out of 42 while BIDU was ranked at number 9.

The chart below shows the comparative performance over the past two years. Normally the two stocks tend to be much more highly correlated. Expectations were for BIDU to outperform PDD over the coming weeks and close the performance gap as it had in the past.

The trade was to buy January 120 calls on BIDU at $4.50 and January 90 puts on PDD for $4.40.

We also always look at implied volatility on every trade to avoid buying expensive options.

In this instance, BIDU IV was well below average at the 26th percentile while PDD puts were even cheaper at only the 11th percentile. Both the BIDU calls and PDD puts were comparatively cheap.

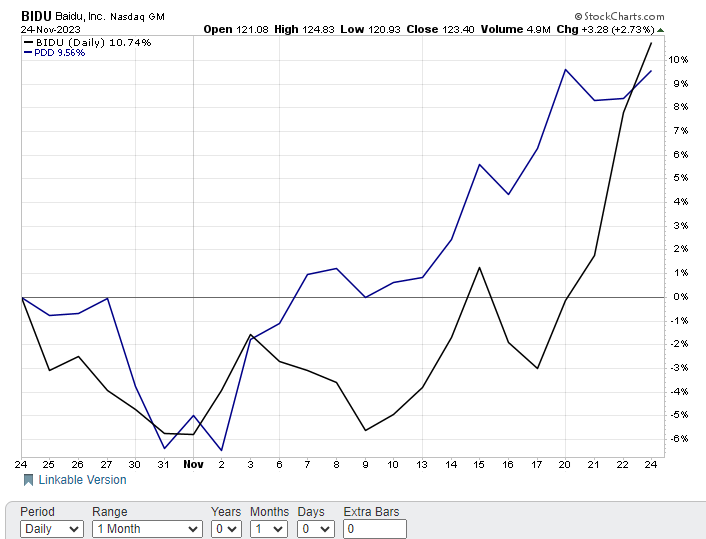

The chart below shows how BIDU has finally outperformed PDD over the past month. Gain of 10.74% for BIDU versus a gain of 9.56% for PDD.

The magnitude of the gains is important as well. Initially the delta on the BIDU calls were 35 at trade inception on October 23. The PDD put delta was a -23 delta. Delta represents the stock equivalent of the options. So our intial trade would have slightly bullish at 12 deltas net long-or about 12 shares of stock.

Fast forward to November 24 and the BIDU call delta rose to 64 while the PDD put delta fell to -7. Now decidedly more bullish at 57 deltas net long. The trade structure of buying both calls and puts benefits from big moves in the underlying stock. In essence, we make more on the calls as both stocks rise than what we lose on the puts.

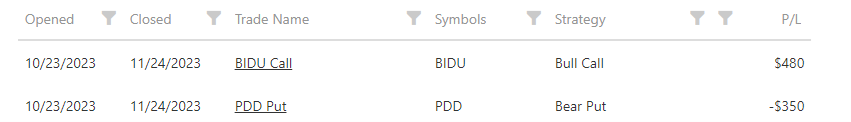

Actual trade details are shown below:

Net gain on the trade was $130- a profit of $480 on BIDU calls and a loss of $350 on PDD Puts. Initial cost was $890 ($450 for the BIDU calls and $440 for the PDD puts).

That puts the net percentage gain on the pairs trade at just under 15%. The holding period was a month. Not a bad 30-day gain on a fairly neutral position. The 15% monthly gain equates to an annualized gain of over 400%.

Not every trade, or even pairs trade, will work out in a similar manner to our China pairs.

As we have said in the past (and likely continue to say in the future), trading is all about probability and not certainty.

But for those looking to put the odds in your favor in a lower risk way, you may want to give the POWR Options methodology a try.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

BIDU shares closed at $123.40 on Friday, up $3.28 (+2.73%). Year-to-date, BIDU has gained 7.89%, versus a 20.38% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network “Morning Trade Live”. His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader.

Tim is the editor of the POWR Options newsletter. Learn more about Tim’s background, along with links to his most recent articles.

The post How to Profit Using The Probabilistic POWR Pairs Process appeared first on StockNews.com