Cheap puts and an expensive stock set up for a put play in Microsoft (MSFT).

Both the S&P 500 and NASDAQ 100 closed right at recent highs on Friday. The equally weighted S&P 500 and NASDAQ 100 still have a way to go before nearing recent highs, however.

The mega-cap stocks like Apple, Nvidia and Microsoft have been the huge outperformers this year which accounts to the divergence between cap weighted QQQ and equal weighted QQQE.

Friday, though, finally showed some struggles for some of these mega-cap names even with the indices closing higher. Microsoft (MSFT), one of the mega-cap leaders, was actually down with both the S&P 500 and QQQ sharply higher.

Has the time arrived to begin to fade the rally in these red-hot names? Let’s take a look at Microsoft using the POWR Options process to see if the manic melt-up may be starting to stall in MSFT.

POWR Options likes to use a combination of fundamental and technical analysis along with looking at implied volatility to uncover trade ideas that have a probabilistic edge. This fusion approach helps put the odds in your favor. No guarantee (this is trading, after all) but an edge.

Let’s take a quick walk through the approach using Microsoft as an example.

Valuation

Microsoft stock is getting pricey once again on a valuation basis. Current Price/Sales (P/S) ratio now stands at the highest level this year and the highest since January 2022.

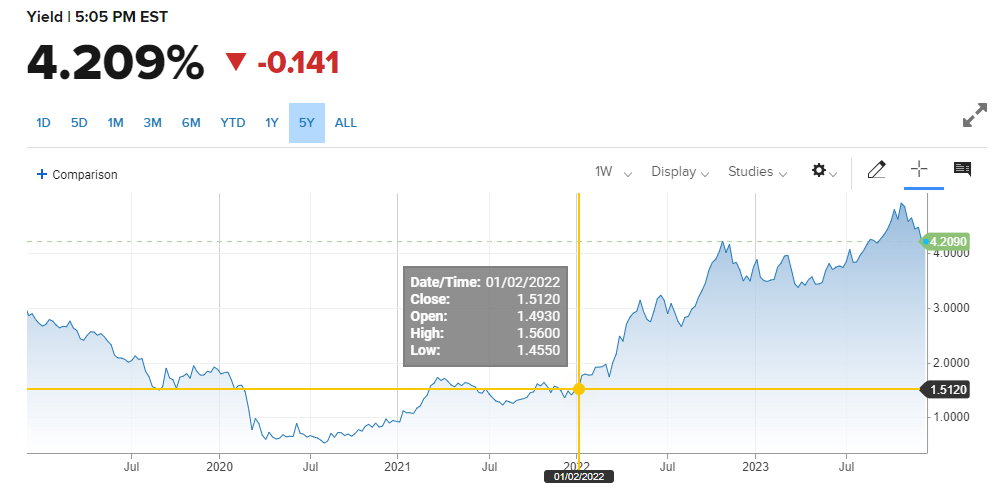

This even though the 10-year Treasury yield is still over 4% and the Fed Funds rate is at 5.25% to 5.5%. Back in January 2022 (the last time MSFT carried such lofty multiples) the Federal Reserve hadn’t even begun to raise rates off zero and the 10-year yield was at just over 1.5%.

To me, such historic increases in interest rates should dampen valuation multiples in a significant way. Plus, a 2.78 trillion dollar market cap company like Microsoft carrying a nearly 13x P/S ratio is difficult to justify since growth rates will necessarily be lessened simply due to the law of large numbers.

Technicals

MSFT stock is also showing some weakness (finally) from a technical perspective. Shares are struggling to break past the $380 area. 9-day RSI reached an extreme at 80 but has since fallen back to 56. Bollinger Percent B exceeded 100 and is now at 61. MACD also reached an extreme but just generated a sell signal by going negative. A break below the 20-day moving average could lead to further downside as it has done in the past.

Implied Volatility

Implied volatility (IV) is hovering at the lowest levels of the past year. This means option prices are cheap. A year ago, the 75-day at-the-money puts were trading at just over a 30 IV. Now the same 75-day at-the-money puts are trading at just a 23 IV.

To put the puts in perspective, the MSFT $255 puts were priced at $13.10 on 12/4/2022 with MSFT stock at $255.02. Now, similar $375 puts are priced at $14.40 with MSFT stock at $374.51. So, the 75-day puts are only $1.30 higher now even though Microsoft stock is $120 points higher! The percentage cost of put protection-and put prices-has dropped considerably to say the least. From over 5% a year ago to under 4% now.

This is the trade idea generation process we use on a daily basis for the POWR Options Portfolio. Combine fundamental, technical and implied volatility analysis in a fusion format.

Investors and traders alike may want to look to buy puts on an overvalued and overbought MSFT stock. The stock price hasn’t ever been this expensive and the put prices this cheap in a very long time.

POWR Options

What To Do Next?

If you’re looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

MSFT shares closed at $374.51 on Friday, down $-4.40 (-1.16%). Year-to-date, MSFT has gained 57.55%, versus a 21.38% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network “Morning Trade Live”. His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader.

Tim is the editor of the POWR Options newsletter. Learn more about Tim’s background, along with links to his most recent articles.

The post 3 Big Reasons Why Microsoft May Not Be A Buy After Going To High appeared first on StockNews.com