Restaurant operator The Cheesecake Factory (NASDAQ: CAKE) stock remains buoyant despite reporting a surprise loss in its Q3 2022 earnings. It operates over 310 restaurants under the Cheesecake Factory banner also including North Italia and Flower Child restaurants. The Company continues to be impacted by the economic headwinds of cost and wage inflation in a potential recessionary backdrop as consumers tighten their discretionary spending. The Cheesecake Factory missed on nearly every metric in its recent earnings report and expects commodity inflation of 15% for its fourth quarter, and yet shares were not only able to snap back from lows, but also breakout through its year-long weekly downtrend channel. When stocks remain resilient after a grim earnings report, it usually means Mr. Market thinks the worst is behind them. Cheesecake Factory shares are down (-13%) for the year, which still outperforms the S&P 500 (NYSEARCA: SPY) down (-21%).

MarketBeat.com – MarketBeat

Word of Mouth Marketing

To its credit, Cheesecake Factory has been a success story that’s grown a multi-generational customer base solely through word of mouth. Casual dining restaurant brands like Darden Restaurants (NYSE: DRI) with Olive Garden, Brinker International (NYSE: EAT) with Chilli’s or Bloomin Brands (NASDAQ: BLMN) with Outback Steakhouse spend a considerable amount on marketing and advertisements through television, newspaper and digital channels. Although it does keep an active presence on social media, The Cheesecake Factory is unique because it hardly spends any money on advertising.

Sugar Crash

On Nov. 1, 2022, Cheesecake Factory released its third-quarter fiscal 2022 results for the quarter ending September 2022. The Company reported a non-GAAP diluted earnings-per-share (EPS) loss of ($0.03), missing analyst estimates for a profit of $0.30 by (-$0.33). Revenues rose 3.9% year-over-year (YoY) to $784 million, missing analyst estimates for $799.2 million. Same store sales rose 1.1% YoY (missing expectations for 2.8%) and 9.5% compared to 2019. Inflationary pressures took its toll on margins. The Company bought back 889,000 shares for $26.7 million in the quarter and increased their stock buyback authorization by 5 million shares, raising total authorization to 61 million shares. The Company plans to open 13 new restaurants in fiscal 2022. The Company ended the quarter with $372 million in liquidity comprised of $133 million in cash and $239 million in available credit.

Keep Your Chin Up

Cheesecake Factory CEO David Overton commented, “While our operational performance has been solid and core cost inputs have become more stable and predictable, we continue to face a dynamic and challenging inflationary environment in some areas. As a result, our profit margins in the quarter reflected higher than anticipated operating expenses particularly in utilities and building maintenance.” He continued, “However, we remain highly focused on returning restaurant margins to pre-pandemic levels in the near-term supported by appropriate pricing actions to offset the higher costs while also managing the business for the long-term including increasing market share.” In an attempt to return margins back to pre-pandemic levels, the Company will be raising menu prices by another 2.8% starting in December 2022. This is in addition to the 4.2% price hikes its already administered.

Impressive Unit Volumes

It’s worth noting that average unit volumes at flagship The Cheesecake Factory brand restaurants track $12 million for the year. This underscores the strong affinity for the brand, even more impressive due to lack of any spend on advertising. Labor productivity and food efficiency exceeded internal expectations but building and maintenance costs were higher than anticipated. The Company opened three new restaurants in the quarter including The Cheesecake Factory in Katy, TX, North Italia in Dunwoody, GA, and its first Fly Bye restaurant in Phoenix, AZ. Fly Bye is its latest fast casual dining concept incorporating Detroit enhanced stretch style pizza and crispy chicken.

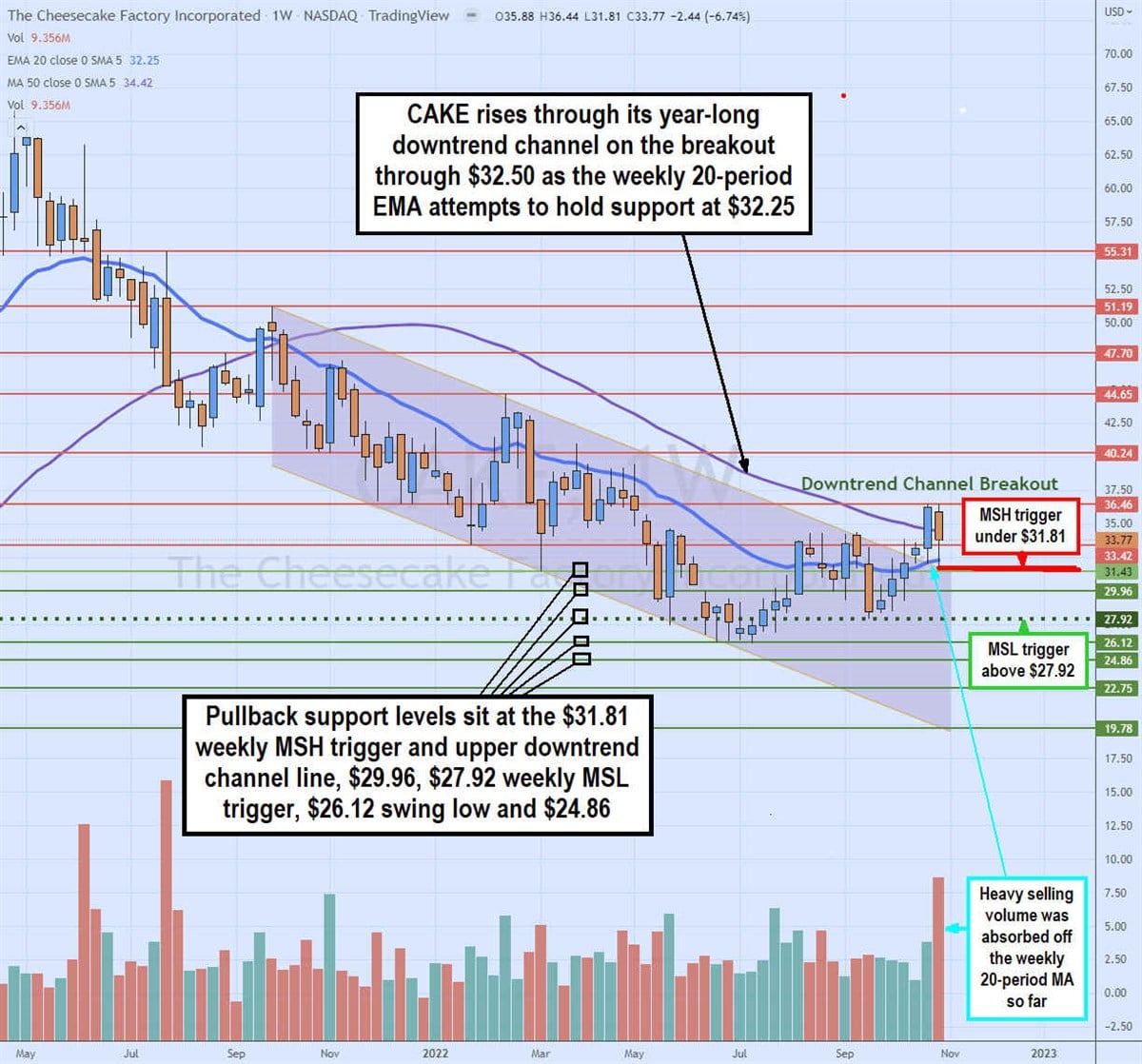

Reversing a Year-Long Downtrend Channel

The weekly chart for CAKE stock illustrates the year-long falling downtrend channel that’s been in place since peaking at $51.19 in September 2021 and hitting a low of $26.12 in July 2022. Shares bounced and gained momentum on the breakout through the weekly market structure low (MSL) trigger above $27.92 on July 18, 2022. This propelled shares to breakout through the upper falling trendline at $32.50 on October 17, 2022. The 20-period exponential moving average (EMA) resistance is now sloping up as support at $32.25 followed by the 50-period MA at $34.42. The recent bounce peaked at $36.46 before pulling back through the weekly 50-period MA to form a weekly market structure high (MSH) sell trigger on a breakdown below $31.81. The weekly 20-period EMA is trying to hold support at $32.25. Selling volume spiked in the last week of October but was absorbed by the weekly 20-period EMA. Pullback support levels to watch sit at the $31.81 weekly MSH trigger, $29.96, $27.92 weekly MSL trigger, $26.12 swing low, and $24.86.