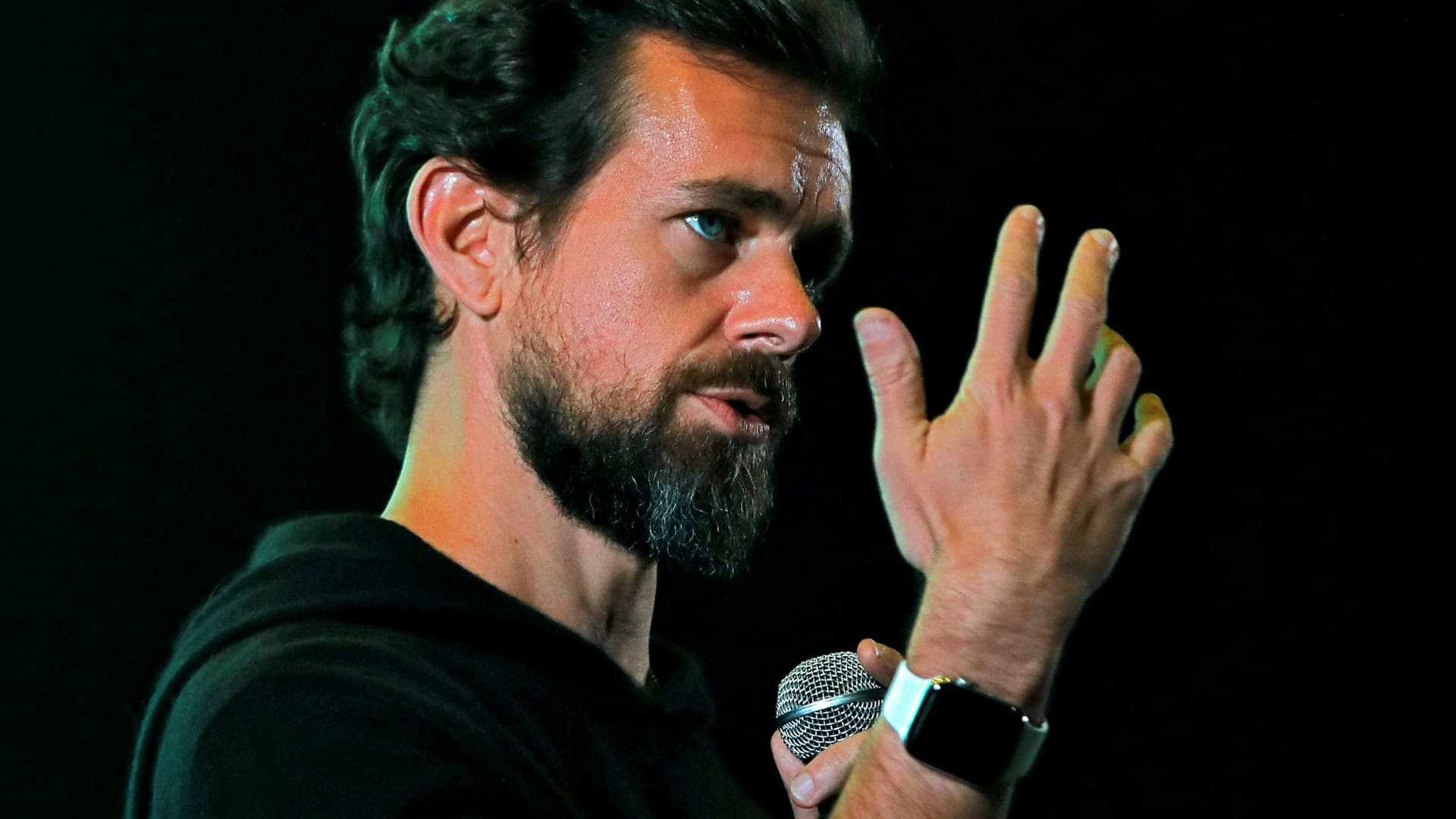

Twitter CEO Jack Dorsey addresses students during a town hall at the Indian Institute of Technology (IIT) in New Delhi, India, November 12, 2018.

Anushree Fadnavis | Reuters

Block stock rose about 3% in extended trading after the payments company reported fourth-quarter earnings that missed Wall Street expectations, but posted strong growth in gross profit.

Here’s how Block did versus Refinitiv consensus expectations:

- EPS: $0.22, adjusted, versus expectations of $0.30

- Revenue: $4.65 billion versus expectations of $4.61 billion

Block posted $1.66 billion in gross profit, up 40% from a year ago. That beat Wall Street expectations of $1.53 billion.

Analysts tend to focus on gross profit as a more accurate measurement of the company’s core transactional businesses.

The company posted a (non adjusted) net loss of $114 million, or 19 cents per share, for the quarter

Block, formerly known as Square, told CNBC in a call that the company ended the year with 51 million monthly transacting actives for Cash App in December, with two out of three transacting each week on average.

Its Cash App business reported $848 million in gross profit, a 64% year-over-year rise, according to Block. During December 2022, Cash App had 51 million monthly transacting actives, an increase of 16% year over year.

The company said that its Cash App Card generated more than $750 million in gross profits in 2022, up 56% from a year earlier.

Its point-of-sale business, Square, saw gross profit grow 22% on an annual basis to $801 million.

Prior to Thursday’s after-hours moves, the stock was up more than 15% in 2023.

Executives will discuss the results on a conference call starting at 5:00 p.m. ET.