How to power up the POWR Pairs Trades to lower risk and increase return in a big range, no change market environment.

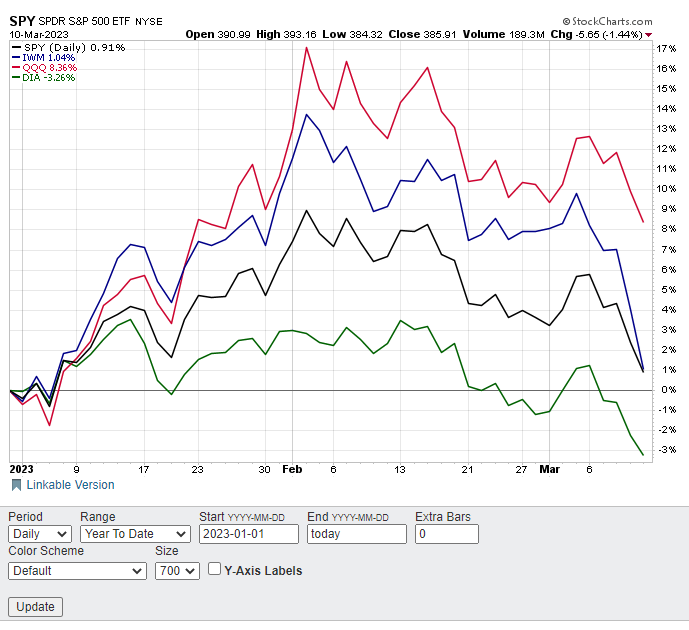

After a rip-roaring start to 2023, stocks have come crashing back to pretty much unchanged on the year.

The NASDAQ 100 (QQQ) still is up nicely so far in 2023 at a little over 8%, but that is more than a 50% drop from the highs in early February. The S&P 500 (SPY) and Russell 2000 (IWM) have fallen further and are clinging to slight gains for the year. The Dow Jones Industrials (DIA) are now firmly in negative territory in 2023.

The roles were reversed in 2022 with the DIA being by far the best performer (down just under 14%) of the four indices while QQQ (down over 25%) was the worst.

This type of big range, no change market environment makes buying stocks more difficult and puts a definite premium on stock picking. Using the POWR Ratings to uncover the best stocks to buy and the worst stocks to sell will be an even decided edge in 2023.

That’s exactly the approach we have used with great success in POWR Options. A POWR Pairs Trade to coin the term.

We start by looking at bullish calls on the highest rated stocks and bearish puts on the lowest rated stocks. This eliminates much of the overall market exposure and distills the relative performance down to the power of the POWR ratings. Higher rated stocks outperform lower rated stocks to a large degree as shown in the chart below.

Then we identify situations where the lower rated stock has out-performed the higher stock in a big way and is in a position to profit from the expected convergence of the two back to a more historically traditional relationship. In the past, we invariably used this pairs philosophy with two stocks in the same industry to further dampen risk.

We also always consider implied volatility (IV) in every trading decision. POWR Options buys comparatively cheap options to further put the overall odds in our favor.

In our latest POWR Pairs Trade, however, we decided to forego the same industry requirement and just look at buying good stocks doing lousy and shorting bad stocks doing too good.

It ended up being a very viable additional approach to our pairs trading philosophy. A quick walk-through our latest POWR Pairs Trade will help shed some light.

While not a “traditional” pairs trade, since the two stocks are in different industries, it still is a POWR Ratings performance pairs trade.

Buying bearish puts on the much lower-rated but much better performing Alcoa (AA) and buying bullish calls on the much higher-rated but much lower performing Bristol-Myers Squibb (BMY).

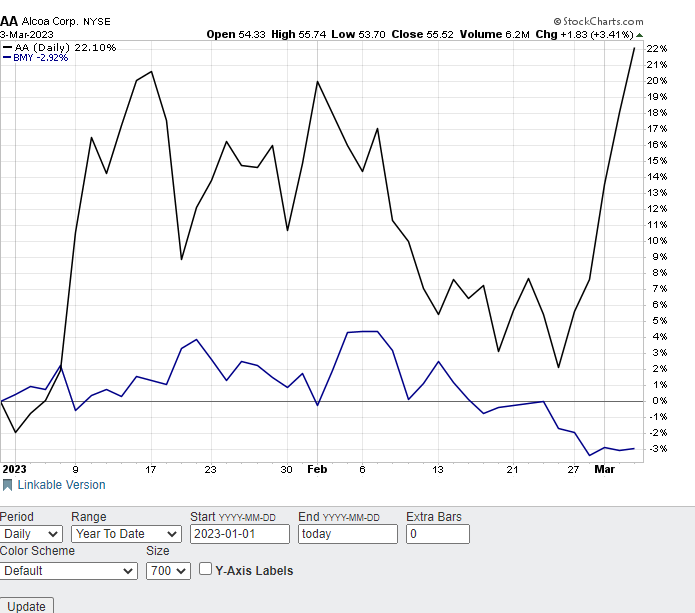

D rated -Sell- Alcoa (AA) is trading at yearly highs for 2023, up 22%.

A rated -Strong Buy-Bristol Myers (BMY) is just off the yearly lows, down about 3% year-to-date.

The chart below shows the comparative performance so far in 2023. Note how AA did drop sharply in February while BMY hugged the flatline. Since the end of February, however, AA has exploded higher once again while BMY has drifted lower. Performance differential got to 25%.

Look for AA to be a relative underperformer to BMY over the coming weeks as the price performance between the two stocks converges as it has in the past.

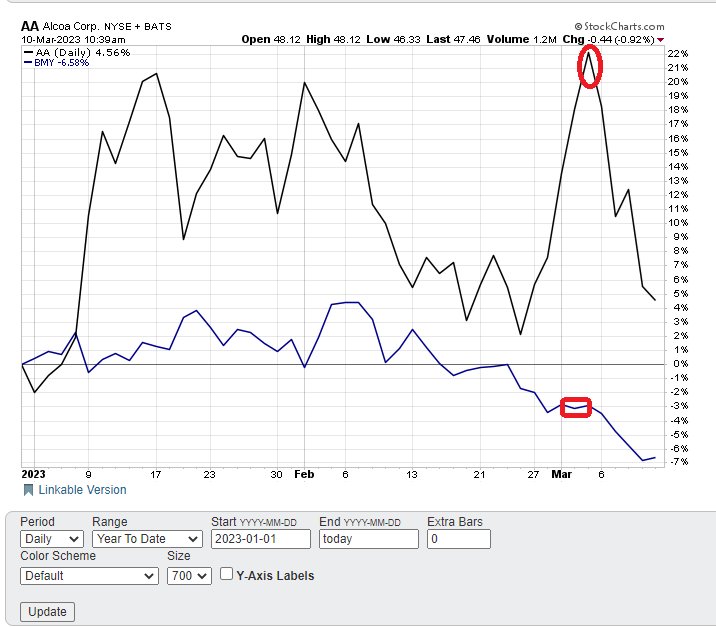

On March 3, The POWR Options portfolio bought the AA June $50 puts for $3.90 ($390 per option) and at the same time bought the BMY June $67.50 calls for $4.20 ($4.20) per option. Total combined outlay was $810.

Fast forward to Friday March 10. You can see how AA has dropped over 17% since the pairs trade was initiated (highlighted in red). BMY has fallen as well, but only a little over 3.5%.

This led to closing out the pairs trade since the spread had converged dramatically. The original performance differential of over 25% on March 3 shrank, or converged, by more than half to just over 11% on March 10.

Just as importantly, implied volatility rose in that time frame. This gave a lift to both our long puts on AA and long calls on BMY. The AA puts went from a 53.81 IV to a 56.30 IV. The BMY Calls rose from a 21.14 IV to a 22.28 IV.

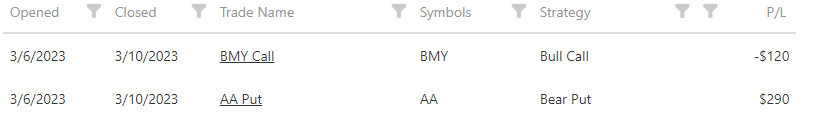

Exited the bullish BMY calls for a loss of $120. Got out of the bearish AA puts for a gain of $290. Net overall gain was $170 ($290 -$120). Actual trade data seen below.

Net percentage gain on the trade was just over 20% ($170 net gain/ $810 initial combined outlay). The holding period was just a week. In on Monday, out on Friday.

Investors and traders looking to generate similar low-risk but solid short-term returns may want to consider using the POWR Pairs Trade approach to significantly reduce the downside but still leave plenty of upside open for grabbing gains.

What To Do Next?

While the concepts behind options trading are simpler than most people realize, applying those concepts to consistently make winning options trades is no easy task.

The solution is to let me do the hard work for you, by starting a 30 day to my POWR Options newsletter.

I’ve been uncovering the best options trades for over 30 years and with the quantitative muscle of the POWR Ratings as my starting point I’ve achieved an 82% win rate over my last 17 closed trades!

During your trial you’ll get full access to the current portfolio, weekly market commentary and every trade alert by text & email.

I’ll be adding the next 2 exciting options trades (1 call and 1 put) when the market opens this Monday morning, so start your trial today so you don’t miss out.

There’s no obligation beyond the 30 day trial, so there is absolutely no risk in getting started today.

About POWR Options & 30 Day Trial >>

Here’s to good trading!

Tim Biggam

Editor, POWR Options Newsletter

shares closed at $385.91 on Friday, down $-5.65 (-1.44%). Year-to-date, has gained 0.91%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network “Morning Trade Live”. His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim’s background, along with links to his most recent articles.

The post Better To Be Bullish Or Bearish? Being Both Is The Best Approach appeared first on StockNews.com