A Lyft decal is seen on a car in the pick-up area at JFK Airport on April 28, 2023 in New York City.

Michael M. Santiago | Getty Images News | Getty Images

Lyft shares dropped nearly 15% in extended trading on Thursday after the ride-hailing company issued a weaker-than-expected forecast for the second quarter.

Here’s how the company did in the first quarter, according to analysts surveyed by Refinitiv:

- Loss per share: 7 cents adjusted vs. loss of 6 cents expected

- Revenue: $1 billion vs. $981 million expected

Lyft reported a net loss of $187.6 million, including stock-based compensation costs and related payroll expenses of $186.6 million. In the year-ago period, the company lost $196.9 million.

Lyft said it expects second-quarter sales of approximately $1.0 billion to $1.02 billion, while analysts were projecting $1.08 billion, according to Refinitiv.

Adjusted earnings before interest, taxation, depreciation and amortization will be $20 million to $30 million, the company said. Analysts in a Refinitiv survey on average were looking for EBIDTA of $49.3 million.

Revenue in the first quarter rose 14% from $875.6 million a year earlier.

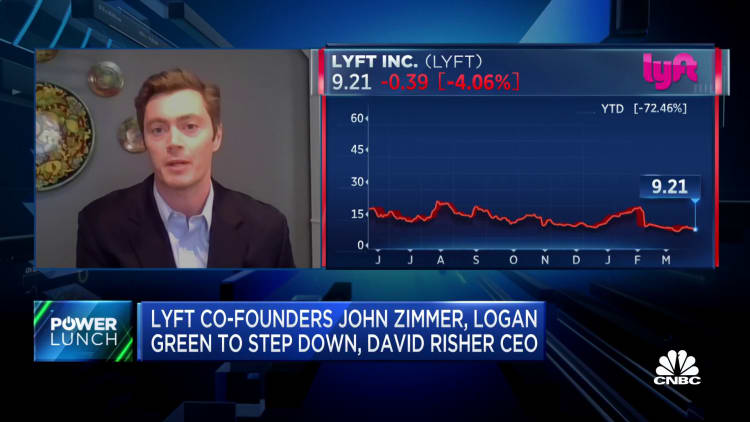

“We’re improving our rideshare service and are thrilled with the early results,” Lyft CEO David Risher said in a statement. “Riders are taking more rides and drivers have the power to earn more.”

Risher, a former retail executive at Amazon, took over the CEO job last month after co-founders Logan Green, who was CEO, and John Zimmer said they would step back from their day-to-day roles at the company.

Prior to the after-hours decline, Lyft shares had lost half their value in the past year.

WATCH: Lyft needs to stabilize higher for the stock to succeed long term