[ad_1]

Affirm Holdings Inc. website home screen on a laptop computer in an arranged photograph taken in Little Falls, New Jersey.

Gabby Jones | Bloomberg | Getty Images

Affirm shares popped 28% on Friday, a day after the buy now, pay later firm reported fiscal fourth-quarter results that topped expectations and gave optimistic guidance for the first quarter.

Here’s how the company did:

- Loss per share: 69 cents vs. 85 cents as expected by analysts, according to Refinitiv.

- Revenue: $446 million vs. $406 million as expected by analysts, according to Refinitiv.

Affirm also gave strong guidance for the fiscal first quarter, projecting $430 million to $455 million in revenue, versus analyst expectations of $430 million.

The company reported gross merchandise volume, or GMV, of $5.5 billion, an increase of 25% year over year, and higher than the $5.3 billion expected by analysts, according to StreetAccount. GMV is a closely watched industry metric used to measure the total value of transactions over a certain period.

Affirm posted a net loss of $206 million, or 69 cents a share, compared to a net loss of $186.4 million, or 65 cents a share, in the year-ago quarter.

Buy now, pay later services such as Affirm soared during the pandemic alongside a boost in online shopping. But Affirm has been contending with a worsening economic environment, as well as rapidly rising interest rates.

“Despite significant changes in interest rates and consumer demand, we still delivered good credit results, unit economics, and GMV growth,” Affirm finance chief Michael Linford said in a statement. “We also demonstrated that the business can continue to expand profitably even in a high interest rate environment.”

The company acknowledged in its earnings report that the resumption of student loan payments in October will be “a modest headwind” to its fiscal 2024 GMV.

Analysts largely cheered the results. Deutsche Bank analysts raised their price target from $12 to $16 and reiterated their hold rating on the stock. They pointed to growth of the Affirm Card, the company’s debit card. Affirm was trading at over $17 a share midday Friday.

“While some uncertainty remains around how AFRM’s model will grow in the out years amid a cloudy macro, the company continues to show differentiated credit performance and we see potential upside to numbers if the Affirm Card lives up to the lofty expectations mgmt. has set for it,” the analysts wrote.

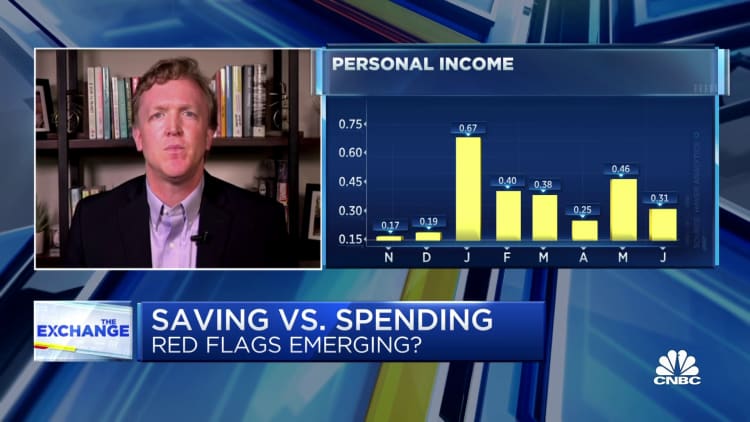

WATCH: Interest rates are forcing consumers to reconsider purchases, says LendingTree’s Matt Schulz

[ad_2]